Need SR-22 insurance assistance?

CALL our licensed Agents

(Mon-Fri, 8am – 5pm PST) for personalized guidance CALL our licensed Agents

(Mon-Fri, 8am – 5pm PST) for personalized guidance |

In Corpus Christi, Texas, SR-22 insurance is a certification requirement for high-risk drivers convicted of serious traffic offenses like DUIs or DWIs, serving as proof of meeting the state’s minimum liability insurance standards. To comply, drivers must file an SR-22 form with the Texas Department of Public Safety and maintain minimum liability coverage of $30,000 per person, $60,000 per accident, and $25,000 for property damage. The SR-22 certification is typically required for two years, and insurance providers must notify the state of any coverage lapses or cancellations. For detailed information on costs, requirements, and how to find affordable options, more information follows.

What Is SR-22 Insurance in Corpus Christi

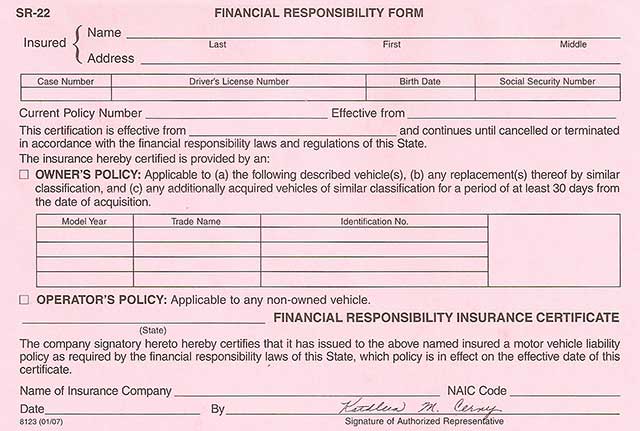

SR-22 insurance in Corpus Christi, Texas, is a form filed with the state to verify that a driver is meeting the minimum auto liability insurance requirements.

It is not a type of insurance itself but rather a certificate that proves the driver has the necessary liability insurance coverage.

In Texas, SR-22 insurance is required for high-risk drivers who have been convicted of serious traffic violations, such as DUIs or driving without insurance.

The SR-22 form must be filed with the Texas Department of Public Safety, and the driver must maintain the minimum liability coverage for at least two years from the date of conviction.

The minimum liability requirements include $30,000 per person, $60,000 per accident for bodily injury, and $25,000 for property damage.

SR-22 Insurance Requirements in Texas

In the state of Texas, drivers who have been convicted of serious traffic offenses, including driving under the influence (DUI) or driving without insurance, are required to file a certificate of financial responsibility with the Texas Department of Public Safety.

This certificate, known as an SR-22, serves as proof that the driver has the necessary liability insurance to meet state minimum insurance requirements.

Key Requirements for SR-22 Insurance in Texas:

- Minimum Liability Coverage: Policies must provide at least $30,000 in coverage for death or bodily injury to one individual, $60,000 for death or bodily injury to more than one person in one accident, and $25,000 in property damage coverage.

- Duration of Requirement: SR-22 insurance is typically required for two years following the conviction date or the date of license suspension.

- Notification: The insurance company must notify the Texas Department of Public Safety whenever the coverage lapses, is canceled, or terminated.

Who Needs SR-22 Insurance in Corpus Christi

Drivers in Corpus Christi who have been convicted of serious traffic offenses, such as driving under the influence (DUI) or driving without insurance, are subject to specific insurance requirements by the Texas Department of Public Safety.

These individuals are classified as high-risk drivers and must obtain SR-22 insurance to reinstate their driving privileges. SR-22 insurance is a certificate that proves a driver has the minimum liability coverage required by Texas law, which includes $30,000 per person, $60,000 per accident for bodily injury, and $25,000 for property damage.

This insurance must be maintained for at least two years to comply with state regulations. High-risk drivers include those with DUI/DWI convictions, multiple at-fault accidents, and repeated traffic offenses.

Obtaining SR-22 insurance is a mandatory step to regain driving privileges in such cases.

Cost of SR-22 Insurance in Corpus Christi

The cost of obtaining SR22 insurance in Corpus Christi can vary greatly, influenced by factors such as the driver’s history, the insurance provider, and the specifics of the traffic violation leading to the SR22 requirement.

- 1. Base SR22 Filing Fee: The actual cost of filing an SR22 can be as low as $25, but it’s the increase in insurance premiums that typically accompanies the SR22 requirement that can markedly impact overall costs.

- 2. Insurance Premium Increases: The average monthly cost for liability-only SR22 insurance in Texas ranges from $75 to $150, depending on factors like location and driving history.

- 3. Additional Factors: Factors such as vehicle type and age, location, age, gender, and credit score also play vital roles in determining the cost of SR22 insurance.

Duration of SR-22 Insurance

Understanding the length of time SR-22 insurance is required can help individuals plan and budget accordingly.

In Texas, the typical duration for maintaining an SR-22 certification is two years, though it can extend to three years depending on the severity of the offense. The requirement begins from the date of the crash, the date of conviction, or the date the judgment was rendered.

It is essential to keep the policy active and make timely payments to avoid suspension of driver’s license and vehicle registration. If the policy lapses or gets canceled, the insurer is obligated to notify the state, potentially leading to further penalties or an extended SR-22 requirement period.

Finding Cheap SR-22 Insurance

Maneuvering the complexities of SR-22 insurance in Corpus Christi, TX, involves a thorough comparison of rates from multiple insurance providers to identify the most affordable options.

To find cheap SR-22 insurance, it is essential to evaluate several key factors that impact your premium rates.

- Compare Insurance Providers: Companies like Dairyland and Progressive often offer competitive rates. Shopping around can help you find the best deal for your specific situation.

- Understand Your Risk Factors: Your age, driving history, and location greatly affect SR-22 insurance costs. For example, insurers categorize drivers with serious violations as high risk, leading to higher premiums.

- Select the Right Coverage: While full coverage includes liability, comprehensive, and collision, choosing liability-only SR-22 insurance can be a more affordable option, with monthly rates ranging from $75 to $150.

Non-Owner SR-22 Insurance in Corpus Christi

Non-owner SR-22 insurance in Corpus Christi provides coverage to individuals required to carry an SR-22 but do not own a vehicle. This type of insurance is designed to meet the state’s minimum liability requirements, ensuring that the individual is covered regardless of the vehicle they drive.

In Texas, the minimum liability coverage amounts are $30,000 for bodily injury or death of one person, $60,000 for bodily injury or death of two or more persons, and $25,000 for property damage.

The SR-22 form is filed by the insurance provider with the Texas Department of Motor Vehicles, and the individual must maintain coverage for at least two years from the date of the conviction or judgment.

Failure to maintain coverage can result in license suspension or additional penalties.

Conclusion

SR-22 insurance in Corpus Christi, TX, serves as a critical proof of financial responsibility, bridging the gap between legal requirements and personal necessity. By fulfilling the state’s minimum liability standards, it reopens the roadway for drivers previously suspended or revoked. The dual goals of compliance and protection align, ensuring that the once-restricted driver can operate with confidence, guided by the principles of responsibility and legality. Financial burdens are alleviated by competitive rates offered by various insurance providers, fostering a smoother shift back to driving privileges.

Additional Resources: