Need SR-22 insurance assistance?

CALL our licensed Agents

(Mon-Fri, 8am – 5pm PST) for personalized guidance CALL our licensed Agents

(Mon-Fri, 8am – 5pm PST) for personalized guidance |

SR-22 insurance in Austin, Texas, is a mandatory policy for drivers with revoked or suspended licenses due to infractions like DUIs and reckless driving. It acts as proof of financial responsibility and requires continuous liability coverage for a minimum of two years. To obtain SR-22 insurance, drivers must secure coverage from an insurance company that files the certificate with the Texas Department of Public Safety (DPS). Average monthly costs for SR-22 insurance are around $88 for minimum coverage post-DUI, with additional nominal filing fees of $15 to $25. Further exploration of specific requirements and insurer rates can provide clearer insights.

What Is SR-22 Insurance in Austin?

SR-22 insurance in Austin, Texas, is a type of high-risk insurance policy that acts as proof of financial responsibility for drivers who have had their licenses revoked or suspended due to various infractions such as DUIs, DWIs, reckless driving charges, or other similar convictions.

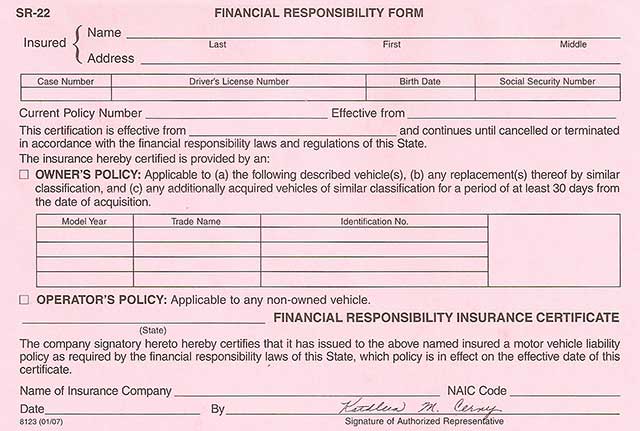

This policy is not an insurance product itself but rather a certificate filed by an insurance company with the Texas Department of Public Safety (DPS) to confirm that the driver has liability coverage.

The primary purpose of an SR-22 is to guarantee that the driver maintains continuous insurance coverage, usually for a specified period of two years, to comply with state regulations.

Failure to maintain coverage can result in license and vehicle registration suspension.

Requirements for SR-22 in Austin

To comply with state regulations, drivers in Austin, who require SR-22 insurance, must meet specific requirements.

An SR-22 is a certificate that proves a driver has the minimum liability insurance necessary to operate a vehicle legally in Texas. The minimum liability requirements include $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage per accident.

Drivers must obtain an SR-22 from an insurance company that offers this service and have it filed with the Texas Department of Public Safety (DPS).

The SR-22 typically needs to be maintained for two to three years, depending on the circumstances that led to its requirement.

Insurance companies may charge a filing fee ranging from $15 to $50, plus the insurance premium, to cover the costs of filing the SR-22 form.

Cost of SR-22 Insurance in Austin

Generally, the cost of SR-22 insurance in Austin, Texas, is considerably higher than standard auto insurance due to the high-risk classification associated with it. This increase in cost is primarily due to the requirement for drivers to file an SR-22 form with the Texas Department of Public Safety, indicating that their insurance policy meets the state’s minimum liability insurance requirements.

- Average Costs: The average monthly cost for SR-22 insurance in Texas is approximately $88 for minimum coverage after a DUI.

- Variation: Rates vary by insurer; State Farm offers the lowest average rate at $52 per month, while Nationwide charges $142 per month.

- Factors: Costs are influenced by individual factors such as driving record, credit history, and age.

- Filing Fees: There is typically a nominal filing fee, ranging from $15 to $25, added to the overall cost.

Finding Cheap SR-22 Policies in Austin

To find the best deal, it’s crucial to evaluate factors such as driving history, age, and location, as these can greatly influence insurance rates.

For non-owner SR-22 insurance, State Farm and GEICO offer the cheapest options, with annual rates of $429 and $899, respectively.

Non-owner SR-22 insurance in Austin

In Austin, non-owner SR-22 insurance provides a critical solution for individuals who do not own a vehicle but are required to maintain SR-22 coverage due to certain offenses, such as driving under the influence (DUI) or accumulating too many points on their license.

This type of insurance guarantees that drivers can legally operate vehicles that they do not own while complying with Texas’s SR-22 requirements.

Key Points:

- Non-owner SR-22 insurance is ideal for individuals who do not own a vehicle but need to meet SR-22 requirements.

- It provides liability coverage but does not include extensive or collision coverage.

- This type of insurance is limited to the named insured and does not cover other drivers.

- State Farm and GEICO offer some of the cheapest non-owner SR-22 insurance rates in Texas.

Reinstating Driving Privileges in Austin

Reinstating driving privileges in Austin involves a series of steps and compliance with specific requirements set by the Texas Department of Public Safety (DPS).

Individuals must first determine the cause of the suspension and any required actions by visiting the DPS license eligibility webpage. If necessary, they must obtain SR-22 insurance, which proves they have the minimum liability insurance coverage required by state law.

To reinstate their driving privileges, individuals may need to submit compliance documentation and pay reinstatement fees online or by mail to the DPS.

Processing times can vary, and it is essential to provide complete and accurate information to avoid delays. Once reinstatement fees are paid and necessary documentation is submitted, the DPS will process the request, typically within 21 business days.

Conclusion

SR-22 insurance in Austin, TX, serves as a beacon of responsibility, symbolizing adherence to state regulations following a license suspension. Requirements include obtaining minimum liability coverage, with costs averaging $88 per month after a DUI, though rates vary among insurers. Non-owner SR-22 policies offer an affordable alternative for those without a vehicle. Reinstating driving privileges hinges on SR-22 compliance, ensuring safer roads and more responsible drivers. Swift processing and adherence to these policies pave the way to restored driving privileges.

Additional Resources:

- Texas State Official Website

- Texas Department of Public Safety (DPS)

- Texas Department of Transportation (DOT)

- Texas Department of Motor Vehicles (DMV)

- Texas Department of Insurance (DOI)

- M.A.D.D. (Mothers Against Drunk Driving)

- Impaired Driving, U.S. Center for Disease Control and Prevention (CDC)

- Drunk Driving, National Highway Traffic Safety Administration