Need SR-22 insurance assistance?

CALL our licensed Agents

(Mon-Fri, 8am – 5pm PST) for personalized guidance CALL our licensed Agents

(Mon-Fri, 8am – 5pm PST) for personalized guidance |

SR-22 insurance in Lubbock, Texas, is a state-mandated certificate of financial responsibility that verifies a driver’s compliance with the minimum liability coverage required by Texas law. This certificate is typically required for drivers who have been convicted of serious traffic offenses, such as DUIs or driving without insurance. To obtain SR-22 insurance, drivers must file the necessary form with the Texas Department of Public Safety and maintain the minimum liability coverage for at least two years. The costs associated with SR-22 insurance can vary based on driving history and location. Understanding the specifics of SR-22 requirements and costs can help navigate the reinstatement process more effectively.

What Is SR-22 Insurance in Lubbock?

SR-22 insurance in Lubbock, Texas, is a specific type of document that verifies an individual has vehicle insurance meeting the state’s minimum liability coverage requirements for reinstating driving privileges following certain offenses or infractions.

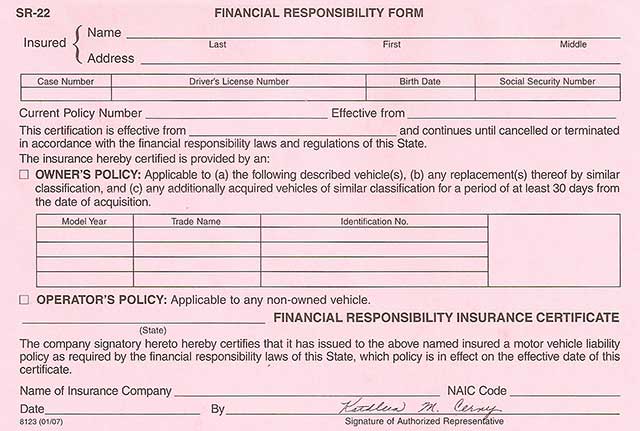

The SR-22, also known as a certificate of financial responsibility, is not an insurance policy itself but rather a filing that must be added to an existing auto insurance policy. It is mandated by the Texas Department of Motor Vehicles (DMV) to guarantee that drivers have the necessary insurance coverage.

In Texas, SR-22 insurance is typically required for two years after the conviction date, particularly for drivers operating under a restricted license.

The minimum liability requirements include $30,000 for bodily injury/death liability for one person, $60,000 for bodily injury/death per accident, and $25,000 for property damage liability per accident.

Who Needs SR-22 Coverage in Lubbock?

In Lubbock, Texas, certain individuals are mandated to obtain SR-22 coverage as a condition for reinstating their driving privileges.

This type of insurance is typically required for drivers who have been convicted of serious traffic offenses or have had their license suspended due to high-risk driving behaviors.

- 1. DWI/DUI Convictions: Individuals convicted of driving while intoxicated or under the influence must obtain SR-22 insurance.

- 2. Excessive Traffic Violations: Drivers who have accumulated multiple traffic tickets within a short period may be required to get SR-22 coverage.

- 3. License Suspension: Anyone whose license has been suspended due to reckless driving, failure to pay fines, or other serious offenses must obtain SR-22 insurance to reinstate their driving privileges.

How SR-22 Works in Texas

To understand how SR-22 insurance functions in Texas, it is crucial to explore the state’s specific requirements and the process of obtaining this type of coverage.

In Texas, an SR-22 is a certificate of financial responsibility that must be filed with the Texas Department of Public Safety (DPS). It is typically required for drivers with high-risk offenses, such as DUI/DWI convictions, driving without insurance, or accumulating too many traffic violations within a specified period.

The SR-22 form verifies that the driver has purchased liability insurance that meets the state’s minimum coverage requirements: $30,000 bodily injury per person, $60,000 bodily injury per accident, and $25,000 property damage.

Once obtained, the SR-22 must be maintained for two years from the date of conviction to avoid further penalties and license suspension.

Costs Associated With SR-22

Obtaining SR-22 insurance in Texas involves not only understanding the state’s specific requirements but also considering the costs associated with this type of coverage. The costs can vary considerably based on factors such as driving history, age, and location.

Factors Affecting SR-22 Insurance Costs in Texas:

- Driving History: Violations such as DUIs and at-fault accidents can considerably increase SR-22 insurance costs. The more severe the offense, the higher the premium.

- Age and Location: Younger drivers and those living in urban areas may face higher SR-22 insurance premiums. For instance, cities like Houston and Amarillo have different average monthly rates.

- Insurance Provider: Different insurance companies offer varying rates for SR-22 insurance. Companies like Dairyland and Progressive often provide competitive rates, emphasizing the importance of comparing quotes.

Reinstating Your Driving Privileges in Lubbock

Reinstating your driving privileges in Lubbock requires the submission of a valid SR-22 insurance certificate to the Texas Department of Public Safety. This process is typically necessary after a serious traffic violation, such as a DUI or driving without insurance.

To reinstate your license, you must first serve the mandatory suspension period, then pay the applicable reinstatement fee, which ranges from $100 to $125 depending on the reason for suspension.

Additionally, you must maintain SR-22 insurance for at least two years, ensuring that it covers the minimum liability amounts: $30,000 per person, $60,000 per accident for bodily injury, and $25,000 for property damage.

Completing any required courses or therapy and submitting all necessary documentation are also essential steps in this process.

Non-Owner SR-22 Insurance in Lubbock

Non-owner SR-22 insurance in Lubbock is a type of liability coverage designed for individuals who do not own a vehicle but need to comply with Texas’s minimum insurance requirements to reinstate their driving privileges.

This type of insurance is often required for individuals who have had their licenses suspended or revoked due to serious traffic violations or other offenses. To obtain non-owner SR-22 insurance, individuals must meet specific criteria and follow a defined process.

Key points to take into account:

- Eligibility criteria: You cannot own a vehicle, and there should not be another vehicle in the household.

- Minimum coverage requirements: At least 30/60/25 coverage is required, which includes $30,000 for bodily injury/death liability for one person, $60,000 for bodily injury/death per accident, and $25,000 for property damage liability per accident.

- Policy duration: Non-owner SR-22 insurance must be maintained for two years to comply with Texas regulations.

Maintaining SR-22 Certification

Maintaining SR-22 certification in Lubbock, Texas, requires careful attention to specific requirements and timeframes.

In Texas, an SR-22 is typically required for two years following a conviction that necessitates this form of financial responsibility. It verifies that a driver has the minimum liability insurance coverage, which includes $30,000 for bodily injury to one person, $60,000 for bodily injury to two or more persons, and $25,000 for property damage in one crash.

To maintain the certification, drivers must guarantee continuous coverage by renewing their auto insurance policy before the SR-22 expires.

Failure to renew may lead to suspension of driving privileges and vehicle registration. It is the driver’s responsibility to keep their SR-22 up to date and file a new one if the original policy lapses or is cancelled.

Conclusion

SR-22 insurance in Lubbock, TX, is a type of high-risk insurance policy required for drivers who have committed certain traffic offenses, such as driving while intoxicated (DWI), or have accumulated too many traffic violations within a specified period. It involves higher premiums due to specific traffic offenses, with non-owner options available for those without vehicles. Maintaining this certification is essential to avoid additional penalties.

Additional Resources:

- Texas State Official Website

- Texas Department of Motor Vehicles (DMV)

- Texas Department of Transportation (DOT)

- Texas Department of Public Safety (DPS)

- Texas Department of Insurance (DOI)

- Impaired Driving, U.S. Center for Disease Control and Prevention (CDC)

- Drunk Driving, National Highway Traffic Safety Administration