Need SR-22 insurance assistance?

CALL our licensed Agents

(Mon-Fri, 8am – 5pm PST) for personalized guidance CALL our licensed Agents

(Mon-Fri, 8am – 5pm PST) for personalized guidance |

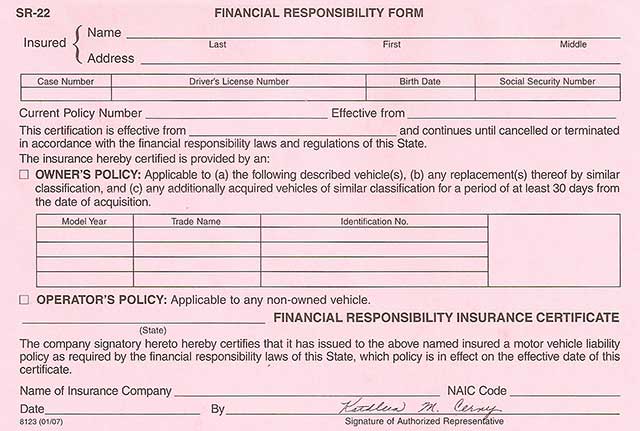

SR-22 insurance in Dallas, TX, is a certificate of financial responsibility required for drivers with suspended licenses due to serious offenses like DPI/DWI. This certificate verifies that a driver has purchased at least the minimum liability coverage required by Texas law: $30,000 bodily injury per person, $60,000 per accident, and $25,000 property damage. The SR-22 form must be filed by an authorized insurance provider with the Texas Department of Public Safety. High-risk drivers face higher insurance costs, with average monthly rates varying from $52 to $142 post-DUI. Further details on cost, filing process, and non-owner SR-22 options are available.

What Is SR-22 Insurance in Dallas?

Obtaining SR-22 insurance in Dallas involves acquiring a specialized certificate that verifies a driver has the minimum liability insurance coverage required by Texas law.

This certificate is not an insurance policy itself but proof that the driver has insurance that meets the state’s minimum liability requirements.

To be compliant, an SR-22 in Dallas must have limits of at least $30,000 for bodily injury or death per person, $60,000 for bodily injury or death per accident, and $25,000 for property damage per accident.

An SR-22 is typically required for drivers who have had their license suspended due to certain high-risk tickets or convictions, such as a DUI or DWI, and must be maintained for two years from the date of the conviction or judgment.

Texas SR-22 Requirements

In Texas, the SR-22 requirements are straightforward and designed to guarantee that high-risk drivers maintain adequate insurance coverage.

Drivers who have been convicted of serious traffic offenses, such as DUIs or driving without insurance, are required to file an SR-22 form with the Texas Department of Public Safety. This form serves as proof that they carry the minimum liability insurance coverage necessary for financial responsibility.

The minimum requirements include $30,000 bodily injury liability per person, $60,000 bodily injury liability per accident, and $25,000 property damage liability.

The SR-22 must be maintained for at least two years from the date of the conviction. It is essential to choose an insurance provider that offers SR-22 filings and to maintain continuous coverage to avoid further penalties and license suspension.

Cost of SR-22 Insurance in Dallas

SR-22 insurance in Dallas, Texas, comes at a higher cost compared to standard auto insurance policies. This is primarily due to the higher-risk nature of the drivers who are required to maintain SR-22 coverage.

The cost can vary considerably depending on several factors, including the driver’s age, the severity and frequency of traffic violations, and the insured value of the vehicle.

On average, the cost of SR-22 insurance in Texas ranges from $52 per month with State Farm to $142 per month with Nationwide for minimum coverage after a DUI.

Specifically in Dallas, rates can fluctuate based on the provider and individual circumstances. For instance, Mercury offers SR-22 insurance at $312.00, while Bristol West charges $546.91, highlighting the importance of comparing rates across different insurance companies.

How to File SR-22 in Dallas

Filing an SR-22 in Dallas involves several key steps, primarily initiated by the insurance company on behalf of the driver. The process is designed to guarantee that drivers who have been required to obtain an SR-22 due to certain violations, such as DWI or multiple traffic offenses, maintain the minimum liability insurance coverage mandated by Texas law.

Key elements to reflect on when filing an SR-22 in Dallas:

- Selecting an Insurance Provider: Choose an insurance company that is authorized to issue SR-22s in Texas.

- Meeting Coverage Requirements: Confirm the policy meets the minimum liability coverage amounts required by Texas law ($30,000 bodily injury per person, $60,000 bodily injury per accident, $25,000 property damage per accident).

- Providing Necessary Information: Provide all necessary information to the insurance company, including your driver’s license number and the reason for the SR-22 requirement.

- Maintaining Continuous Coverage: Keep the SR-22 policy active for the required period to avoid license suspension.

Cheap SR-22 Insurance Providers in Dallas

Obtaining affordable SR-22 insurance is essential for drivers in Dallas who are required to maintain this type of coverage due to specific traffic violations.

Several insurance providers offer competitive rates for SR-22 insurance in Dallas. Companies such as Mercury offer some of the cheapest SR-22 insurance, with average rates of $312.00, considerably lower than providers like Bristol West, which averages $546.91.

Serenity Group and SR22Savings also provide affordable SR-22 insurance options in Dallas, catering to different needs, including non-owner SR-22 insurance for those who do not own a vehicle but may drive occasionally.

Maintaining Dallas SR-22 Coverage

In Dallas, maintaining the required SR-22 insurance coverage is crucial for drivers who have been mandated to carry this type of insurance due to serious traffic violations.

The duration of the SR-22 requirement typically ranges from 3 years but can extend up to 5 years or longer depending on the severity of the offense and any additional infractions during this period.

Key points to take into account for maintaining SR-22 coverage in Dallas include:

- Maintain continuous coverage for the entire mandated period, usually 3 years, to avoid license suspension.

- Guarantee timely payments to prevent policy lapses.

- Renew the policy before it expires to maintain uninterrupted coverage.

- Understand that any lapse in coverage will be reported to the DMV, potentially leading to license suspension.

Non-Owner SR-22 Insurance in Dallas

For individuals in Dallas who do not own a vehicle but have been mandated to carry SR-22 insurance due to serious traffic violations, non-owner SR-22 insurance provides a specific solution.

This type of insurance policy is designed for those who do not own a vehicle but occasionally drive vehicles that are not registered to them or their household.

Non-owner SR-22 insurance in Dallas includes basic liability coverage, which meets the minimum state requirements of $30,000 for bodily injury to one person, $60,000 for bodily injury to more than one person in one accident, and $25,000 for property damage.

This coverage guarantees that drivers have the necessary insurance to cover damages in case of an accident, even if they are driving a borrowed vehicle.

It is a critical requirement for license reinstatement and compliance with Texas DPS regulations.

Conclusion

The path to reinstating driving privileges in Dallas, TX, is symbolized by a beacon of financial responsibility – SR-22 insurance. This form serves as a bridge, connecting high-risk drivers to the Texas DMV‘s minimum liability requirements. The cost of SR-22 insurance in Dallas averages $88 per month for minimum coverage after a DUI, with providers like State Farm and Progressive offering competitive rates. Maneuvering through SR-22 insurance involves understanding Texas’ requirements, comparing quotes, and maintaining coverage to avoid further penalties.

Additional Resources:

- Texas State Official Website

- Texas Department of Public Safety (DPS)

- Texas Department of Motor Vehicles (DMV)

- Texas Department of Transportation (DOT)

- Texas Department of Insurance (DOI)

- Traffic Safety Publications

- Impaired Driving, U.S. Center for Disease Control and Prevention (CDC)

- Drunk Driving, National Highway Traffic Safety Administration